What Is The Financial Market? Know In Details About Financial Market

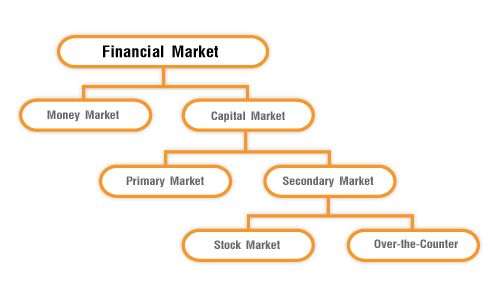

Here are some instances of the financial market and the role these financial markets play in the real estate market, and the stock market. These financial markets are divided into currency markets and capital markets. And also the primary market, and the secondary market.

Today, we are going to discuss the topic to give you a handful of information regarding the financial market. Let’s know in detail.

WHAT IS THE FINANCIAL MARKET?

Each and every time we think about the market, our mind shows a vivid image of a place where there will be many shops or maybe a mall, or where you can go shopping. But the stock or finance market is not such a market.

The selling and buying of shares in the financial market are done entirely by the computer in an automated manner. Any buyer or buyer shares his or her order on the exchange by his or her broker after a moment’s notice; the automation of the deal is matched according to the pending orders. A financial market is a place where you can do any flexible investment according to your business budget.

During the working hours of the stock exchange, brokers place their orders in their order terminals for their customers. In return, the broker gets brokerage.

What Are The Main Functions Of The Financial Market?

The primary functions of the financial market are as follows:

- There is an agreement between investors and borrowers.

- Protecting financial property transactions

- Liquidity of the sale of investors’ financial assets

This is to ensure the minimum cost of transactions and other related information.

What Are The Types of Financial Markets?

There are two types of financial markets :

Currency market:

A Money Market is a short-term market of funds that deal in financial assets which have a maturity period of up to one year. There is a transaction of credit documents under the currency market such as exchange, affidavit, commercial paper, etc.

Document of the Currency Market

It is used mainly by banks to fulfill the requirement of their temporary cash, they borrow and pay each other on a daily basis on a daily basis.

Its repayment is payable on demand and its maturity period ranges from one day to 15 days, the rate of interest to be paid on the amount of money is called the solicitation rate.

Treasury Bill of The Currency Market

Treasury Bill is a pledge issued by the Reserve Bank of India to meet the need for short-term financial funding. Treasury bills are a high liquidity document whose holder can ever transfer to another party or the Reserve Bank These bills can be redeemed at discounted rates.

And their refinement is at face value, so the difference between the issue price and the face value shows the interest in the appropriation.

Check Related Article:-

- Finance Stock Market Courses In India For A Better Future

- Financial News Online: Know in Details About Online Market

- 12 Top Financial Marketing Trends Of 2019

- A Knowledge About Fashion Industry Waste Management

- What Are The Impact Of The Growth Of Textile Industry In India

- What Are the Importance of office management?

Commercial Paper of The Currency Market

The CP is an accessible document for the fulfillment of the need for the working capital of commercial paper companies. It is an unsafe document that is issued as a pledge. This document was first released in 1990 so that the companies through its own It can be borrowed from 15 days to one year time to borrow short-term funds.

Deposit certificate of The Currency Market

A deposit certificate is a short-term document that is issued by commercial banks and by specific financial institutions and which is freely transferable from one party to the other, the maturity date of the savings letter is from 91 days to one year. This form can be issued to individuals, co-operatives, and companies.

Business Bills of The Currency Market

Generally, buyers borrow money from traders, wholesalers, or producers. The seller receives the price of the goods after the term of the loan, but if the seller does not want to wait for the price of the goods or if he needs immediate money then he can write an exchange letter in favor of the buyer If it gives approval, then it becomes an exchangeable document, this is called a business letter or exchange letter.

Capital market:

The capital market refers to the market that does business in medieval and long-term funds, it is an institutional arrangement for long-term and medieval credit, which facilitates the marketing and trading of securities, hence, all long-term debt from banks and financial institutions, Loan from foreign markets and various securities such as deposits, deposits, and bonds include capital Or.

There are two main parts of the capital market

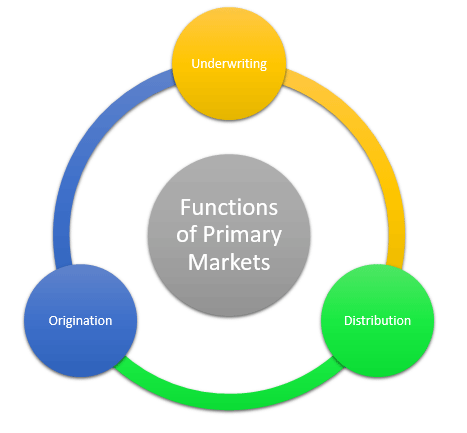

Primary market:

The primary market is concerned with the system through which companies receive long-term loans through the issuance of new shares and debentures. It does this at the time of the expansion of its business. Our friends, relatives, and financial institutions in person or general individuals can do this.

Secondary market:

The secondary market, which is known as the financial market or stock market, shares play an essential role in long-term finance, by providing the necessary liquidity to the loan letters. It is a place where you can get encashment of these securities, without any difficulty or Delayed. It is an organized market.

New securities are traded in the primary market, hence it is also called a new issuing market. Whereas the securities traded in the secondary market are bought and sold, it is also known as the scandal market or financial market, or the financial market.

Difference Between The Primary Market And Secondary Market

- The main task of the primary market is to collect the following funds through the implementation of new technology. Similarly, the secondary market provides a continuous and immediate market to the existing securities.

- Participants are the central participating financial institutions, mutual funds, subsidiaries, and personal investors, whereas, in addition to all these participants in the secondary market, there are brokers who are members of the stock exchange.

- Need to be listed- Primary market securities are not required to be listed, whereas, in the secondary market, only transactions of those securities may be listed.

- Pricing values – Pricing of securities in respect of the primary market is done by the management keeping in mind the guidelines of SEBI, while the value of securities in the secondary market is assessed by the coordination of the existing demand and prerequisite in the market, the time According to, it keeps changing.

So, Knowing these financial market details enhances your business.