Legendary Investors You Should Know About

Much the same as each other industry of our cutting edge live, the monetary area has its good examples and geniuses the sort of examples of overcoming adversity that wannabe financial specialists long for. Since the initiation of business, there has been a huge load of people that have figured out how to place limited quantities of capital into ventures that wind up swelling into a few times their unique speculations.

We generally need to know how our saints stirred their way up from the base. With regards to contributing, we need to realize how the greatest players got to where they are currently how we can copy their strategies to develop our own heaps of money. Tragically, Warren Buffett-level achievement won’t arrive at by far most of our lives – yet that can’t prevent us from taking as much motivation from a portion of the top speculators ever. Here are the ten most incredible financial specialists who have ever graced this planet.

10. Peter Lynch – $2.4 Trillion:

Celebrated Quote: “Your financial specialist’s edge isn’t something you get from Wall Street specialists. It’s something you as of now have. You can beat the specialists in the event that you utilize your edge by putting resources into organizations or enterprises you as of now comprehend.”

Image source: Twitter

Age: 74, Managed Fidelity Investments Assets Under Management (AUM): $2.4 trillion

With regards to avoiding any and all risks, file subsidies that typify the market, all in all, have been strong speculations throughout the long term. For quite a long time, expanded portfolios have been filling out many individuals’ retirement reserves – on account of the in general worldwide development that we’ve seen (hindered by some inconsistent downturns). The S&P500 Index has done well overall, and just probably the most skilled speculators around have figured out how to create better returns – and you can remember Peter Lynch for that rundown.

Lynch is known generally from his administration of the Fidelity Magellan reserve, where he beat the S&P500’s early development for 11 of the 13 years that he was there (up until 1990). He reliably accomplished more than twofold the file’s yearly returns and aided lift the association’s resources from $18 million to $14 billion in worth. This unbelievable speculator authored the saying “put resources into what you know” which I wager you’ve heard previously!

9. Bill Gross – 1.75$ Trillion Assets:

Acclaimed Quote: “Finding the best individual or the best association to put away your cash is one of the main monetary choices you’ll actually make.”

Age: 74, Cofounder of PIMCO Assets Under Management (AUM): $1.75 trillion

This substantial hitter is known as “the King of Bonds” – alluding to his wild achievement in fixed-pay speculations that has prompted him to get known as probably the best financial specialist ever. Bill Gross established a little speculation the executive’s organization called PIMCO, which at present has $1.77 trillion in resources under administration (AUM). At a certain point as expected, Mr. Net was the greatest security store director (by esteem) at one point as expected, and PIMCO really sunk when he moved to work for Janus Capital Group in 2014.

Bill Gross is an alternate sort of big-time speculator and cautions would-be business people against putting resources into “zombie enterprises” – by placing cash into the genuine economy with companies that you have a positive outlook on both morally and monetarily. He likewise focused on broadening and taking risks that are established in comprehensive exploration, just as keeping up enough fluid money as an afterthought.

8. Warren Buffett – $702 billion:

Renowned Quote: “We essentially endeavor to be unfortunate when others are avaricious and to be insatiable just when others are unfortunate.”

Image source: Wikimedia

Age: 87, CEO of Berkshire Hathaway Assets Under Management (AUM): $702.1 billion Twitter: @WarrenBuffett (1.4 m adherents)

This is a name that you’ve absolutely heard previously: Warren Buffett. Across the globe, he is broadly known just like the best financial specialist ever – generally, as a result of the limited quantity of cash, he began with (he is as of now worth near $85 billion). Mr. Buffett is referred to continually in a wide range of monetary distributions, and financial specialists hopefuls pay attention to his recommendation incredibly.

In the event that you open up the front pages of information locales like Business Insider or Forbes, you are probably going to see a connection with Buffett’s name referenced – and there is an explanation behind that. He heads Berkshire Hathaway, and in a real sense makes markets move fiercely one or the other way by offering a basic remark. His understudies have figured out how to comprehend the estimation of organizations by focusing on income telephone calls and understanding their monetary records – just as just assessing the cost of an offer after appropriately believing in the association.

John “Jack” Bogle – $5.1 Trillion:

Celebrated Quote: “The horrid incongruity of contributing is that we financial specialists as a gathering don’t get what we pay for, we get decisively what we don’t pay for.”

Age: 89, Founded The Vanguard Group Assets Under Management (AUM): $5.1 trillion

This speculator is a flat legend in that he established an organization that is basically a family unit foundation now: The Vanguard Group. Most Americans, in any event, perceive this name as a wellspring of ease common asset ventures, however, John “Jack” Bogle is known for far beyond that.

Truth be told, Fortune magazine named him as one of the “four venture goliaths of the twentieth century” in 1999, and his book “Sound judgment on Mutual Funds: New Imperatives for the Intelligent Investor” is a broadly perused exemplary that is exceptionally respected in the speculation community. Bogle is maybe generally noted for establishing the main record common asset that was accessible to the overall population which occurred in 1976 when he established the Vanguard Investment Trust, which would later turn into the Vanguard 500 Index Fund.

6. Bill Miller – $752 billion

Acclaimed Quote: “Value contributing methods truly asking what are the best qualities, and not accepting that since something looks extravagant that it is, or expecting that in light of the fact that a stock is down in cost and exchanges at low products that it is a deal”

Age: 68, previous Chief Investing Officer of Legg Mason Capital Management Assets Under Management (AUM): $752.3 billion

One short-expression strikes a chord when one considers Bill Miller: history. With regards to a series of wins, Mr. Mill’s operator is perhaps the most broadly known achievement in the speculation network. For 15 strong years, somewhere in the range of 1991 and 2005, his Legg Mason Value Trust beat the S&P500’s yearly return. In 1999, he was named the “Asset Manager of the Decade” by Morningstar.com.

Mill operator effectively developed his asset from a measly $750 million to over $20 billion (resources under administration) up until 2006. Indeed, even a year ago he was wrenching out comparative achievement: his Opportunity Trust beat the S&P500 by almost twofold at specific focuses a year ago. He is viewed as a worth speculator, however, intensely accepts that any stock can possibly be a worth stock “on the off chance that it exchanges at a markdown to its inherent worth.”

5. Huy Ya Kan – $275 billion

Celebrated Quote: “We should zero in speculation on youth development.”Age: 59, Founded Evergrande Real Estate Group Assets Under Management (AUM): $275 billion

Moving to a more current contributing monster, we should go on an outing to China to zero in on probably the most extravagant individual in the whole East Asian country: Hui Ka Yan (Xu Jiayin in Mandarin). Right now worth over $30 billion USD, he is the director and biggest investor of China Evergrande Group – a greatly effective Chinese property build-up that has built more than 500 undertakings in 180 Chinese cities.

Hui Ka Yan created amazing benefits from both private and place of business ventures, and a year back it helped its offer cost by a stunning 469%. He was the most extravagant man in China a year ago, and in 2017 he was the head of the 26% generally speaking lift in the territory’s main 400 fortunes. Presently, he has slipped to third place which actually isn’t excessively ratty at all when you consider the big picture.

Benjamin Graham:

Popular Quote: “In the short run, a market is a democratic machine yet over the long haul, it is a gauging machine.”Lived: 1894-1976, Founded Graham-Newman Partnership Mostly known for his scholastic work

Image source: Wikimedia

Known as the “Father of Modern Investing,” Benjamin Graham was really a guide of Warren Buffett’s. Truth be told, he is the very speculator that is acknowledged for concocting the idea of “significant worth contributing,” which basically reduces to the possibility that we should purchase protections that are right now undervalued as to augment the benefit that you can produce when they become completely acknowledged and beneficial organizations. Graham’s super famous neoclassical contributing texts, Security Analysis and The Intelligent Investor are verifiably significant in the realm of contributing – zeroing in on financial specialist brain research, concentrated expansion, extremist contributing, and negligible obligation. Various understudies of Grahams have gathered unimaginable achievements, like Buffett, Irving Kahn, Walter J. Schloss, and William J. Ruane.

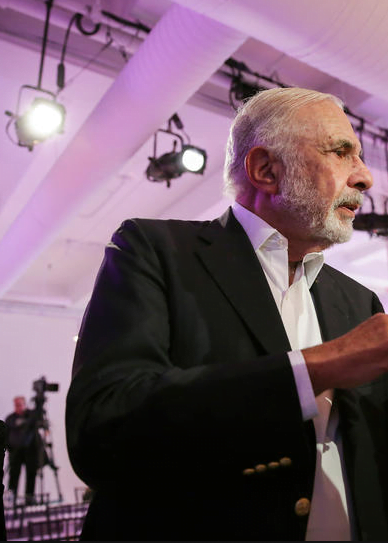

3. Carl Icahn – $33.3 billion:

Celebrated Quote: “In takeovers, the similitude is war. The mystery holds. You should have saves the extended route ahead. You need to realize that you could purchase the organization and not be extended.”

Age: 82, Founder of Icahn Enterprises Assets Under Management (AUM): $33.3 billion twitter: @Carl_C_Icahn (354k followers)

Carl Icahn assembled his standing as what’s called a corporate raider –a financial specialist who invades a fumbled organization’s top managerial staff by buying enough offers to get casting a ballot power. Effective plunderers at that point utilize their influence to modify the association trying to make it beneficial, or simply strip their resources – which Icahn broadly did after his antagonistic takeover of the American Airline TWA, thinking back to the 80s.

Icahn was the 26th most extravagant individual on the Forbes 400 a year ago, also the fifth most extravagant mutual funds chief. He likewise quickly worked with the President of the United States, Donald J. Trump, as a Special Advisor on Regulatory Reform, for a short spell in 2017. He is presently worth twofold digit billions. This unbelievable corporate plunderer has his fruitful fingerprints on combinations like Yahoo, Time Warner, and Blockbuster Video as well.

2. Charlie Munger – $702 billion:

Image source: flickr

1. Geraldine Weiss:

Famous Quote: “Never is there a better time to buy a stock than when a basically sound company, for whatever reason, temporarily falls out of favor with the investment community.”

Image source: iqtrends

Age: 92, Founder of Investment Quality Trends Known for academic work