Informative Report Of Demat Account: Get A Brief Idea Of It

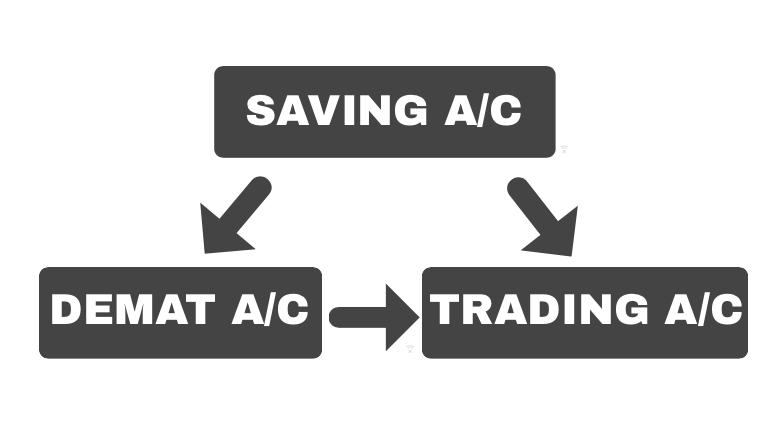

The demat account works like just like a bank account. Here too, only the passbook of the bank balance can be entered, you can’t keep it in physical form, its protection is also electronic, and it is credited as a debit to the bank account. Today we have provided the informative report of demat account to make it easier for you to understand what demat account is and also know how it works.

Why Should One Need A Demat Account?

According to SEBI (Securities and Exchange Board of India) guidelines, shares can’t be sold or bought in any form other than demat. Therefore, if you have to buy or sell stock from the stock market, then you have to have a demat account. An informative report of demat account will help you to understand the process clearly.

How Does Demat Account Work?

When you buy a stock, the broker credits the stock with the demat account and it appears in the details of your holdings. So, if you do business with an internet-based platform, you can view your holdings online. In particular, the broker shares the shares on T + 2, which is trading day + 2 days later.

When you sell shares, you have to give delivery instructions to your broker, in which you have to fill in the details in the stock sold. The stock gets debited in your account and you pay the money for the shares sold. If you pay from the internet, the debit of shares and the amount of credit appear in your account automatically.

According to guidelines issued by SEBI in India, the Demat Account service is given by two major institutions, both of which are institutions,

- NSDL (The National Securities Depository Limited)

- CDSL (Central Depository Services (India) Limited)

An Informative Report on Demat Account Introduction:

You already know what a demat account really is. Let’s now know more about the basics of the demat account before we start talking about the informative report of demat accounts.

Check out the basics related to the demat account below:

- You will have to link your PAN Card with your demat account

- You can open as many demat accounts as possible but with different stockbrokers.

- A Unique Identification No. will be linked to the demat account while opening. This will differentiate your account from the other investors

- You can easily transfer credit or money from one demat account to another demat account

- Every stockbroker does not have provision to open the demat a/c directly. So, check before choosing your stockbroker by going through an informative report of demat account carefully.

- There is no minimum limit for opening a demat account.

Informative Report Of Demat Account Charges:

For the demat account, you will have to pay for brokerage charges mainly. In addition to demat account brokerage charges, you may have to pay some other charges for maintaining your account. These charges are mentioned below. Check out the charges carefully.

Opening charges for Demat Account:

In order to initiate the trading journey, it is mandatory to open the demat account as well as there are particular charges for opening the demat account.

NOTE:

There are particular charges for opening the demat account, which may vary from INR 0/- to INR 1200/- depending on the stockbroker.

Annual Maintaining Charges Of Demat Account:

Once you are done with your demat account opening process, then the stockbroker will charge you for the demat account maintenance charges per year. This maintenance charges may vary from INR 0/- to INR 1000/- depending on your stockbroker.

In order to maintain your administrative tasks associated with the demat account, this charge will be levied. In lieu of operations performed for the backend works, the broker charges the Annual Maintenance Contract (AMC).

Transaction Charges For The Demat Account:

The Securities and Exchange Board of India (SEBI) charges a particular percentage (%) on every trade you make on your stock market. Nevertheless, the amount is a very low percentage of the trade, somewhat around 0.00325% only. Although the amount becomes huge at your daily market turnovers on the stockbroker.

Charges For The Trading Platform Usage:

Most trading platforms that you use here are basically free of cost. However, some stockbrokers ask for a license of third-party software & other stockbrokers may develop some of the top-notch requests to use their own software. In order to custom this software; these agents levy a convinced fixed sum from the consumer on a regular basis.

Points & Objectives Of A Demat Account:

The fundamental target of the investigation is to think about the capability of the market with respect to individuals’ managing in the offer market.

Strategy & Methodology Of A Demat Account:

Research Methodology alludes to the inquiry of learning. One can likewise characterize investigate philosophy as a logical and deliberate scan for required data on a particular theme. The methodology means research as a careful investigation or inquiry especially through research for new actualities in my branch of information.

For instance, some creator needs to characterize research methodology as a systematized effort to gain new learning.

Essential Data Collection:

In managing the genuine issue usually discovered that information close by is insufficient, and thus, it ends up important to gather the information that is suitable.

There are a few different ways of collecting the suitable information which contrasts impressively in the context of cash costs, time and other resources at the transfer of the analyst

Auxiliary wellsprings of information:

The secondary sources of data are used. (Internet, magazine, books, journals)

Through close to home meetings

A rigid procedure was followed and we were seeking answers to many pre-imagined inquiries through close to home meetings.

Through Tele-Calling

Data was likewise accepted through phone calls.

Through poll

Data to discover the speculation potential and objective was discovered through surveys.

Tool To Open The Demat Account:

At first, go to the official demat account opening page

Create a password for your account opening portal

Now enter your PAN Card no. and then continue

Pay your demat account opening fees if required

Finally, enter your adhaar card no. and click on the submit button

You will receive an OTP (One-time Password) to validate the password

Fill in all the required details in the given boxes for the KYC (If you do not complete your KYC then you will have to complete the In-Person Verification (IPV)

Upload the documents such as income proof

Submit to complete your demat account opening process

NOTE:

Every one of your buys/interests in securities will be credited to this account. In the event that you move your securities, your demat account will be charged.

Recommended Articles:-

- Online Mutual Fund Investment Process & Companies In India

- Business Ideas With Low Investment And High Profit

- Importance Of Demat Account In Share Market

- Mutual Fund Rates Of Different Mutual Fund Company

- Some Important Share Market Tips For Beginners

- Know In Details About The Best Demat Account In India

Documents Required For A Demat Account Opening:

To open the demat account, you will need to collect all the below mentioned documents. Check out the list of documents required for the demat account:

Address Proof such as

- Voter ID

- Aadhar Card

- Ration Card

- Passport

- Driving license

- Bank statement

- Rental agreement

- Verified Electricity Bill

- A college ID card for students only

- Passport Size Photo

- PAN Card

- Income Tax Return documents

- An account opening form and signed power of attorney

- A canceled cheque in your name

Advantages of Demat account:

So, let’s now check out the benefits of the informative report of demat account below:

- You can save you shares in an electric format via a demat account

- And then you’ll be able to transfer your securities quickly and easily via your demat account

- You won’t need to go through any paperwork for the opening of the demat account. So, the process is hassle-free

- Buying and selling shares are easier with demat account

- With the demat account, there is no risk of robbery, theft to the shares

- The transfer process is easier in case the death of the account holder

- It is very easy to close a demat account

Disadvantages Of The Demat Account:

Besides the advantages, the demat account has some disadvantages too. So, let’s check out the disadvantages in the informative report of demat account

- It is very important to understand the online platform to place an order such as buying or selling shares or transferring money with other demat accounts

- Placing an order via call is time taking if you are not pro at it

- Different stockbrokers come with different types of terms and conditions which sometimes prove to be carrying more disadvantages than advantages. So always check before opening the demat account

Demat Account Nomination:

Whenever you go to open a Demat Account, you have to enter Nominee’s name on the application form, it is necessary to enter the name of the Nominee person, in case of an accident, transfer of nominee to the deposits in the demat account.

If you have opened the account, and have not named the nominee, then you have your bank or stockbroker where your account is, contact them and fill the nominee form, in the event of an accident occurring in the future. So, It will be very beneficial.

FAQ Regarding Informative Report of Demat Account:

Q. How to open a Demat account?

A. At first, go to the official demat account opening page->Create a password for your account opening portal->Now enter your PAN Card no. and continue->Pay your demat account opening fees if required…find out more here

Q. How long does it take to open a Demat account?

A. According to guidelines issued by SEBI in India, the Demat Account service takes a maximum of 48 hours to 72 hours to open the account. However, if you open the account with the help of any broker then the account can be opened within 1 hour…

Q. Can I have two Demat accounts?

A. Yes, it’s absolutely okay to possess two or more demat accounts. You will not face any lawful problems. An individual can open as many demat a/c as the person wants…

Q. What are the charges of the Demat account?

A. Once you are done with your demat account opening process, then the stockbroker will charge you for the demat account maintenance charges per year. These maintenance charges may vary from INR 0/- to INR 1000/- depending on your stockbroker…

Q. What are the documents required to open a Demat account?

A. To open the demat account, you will need to collect all the below mentioned documents. Check out the list of documents required for the demat account. You will need any of these address Proof such as Voter ID/Aadhar Card/Ration Card/Passport…Check out the list here

Q. Can I include any nominee in my Demat account?

A. Whenever you go to open a Demat Account, you have to enter Nominee’s name on the application form, it is necessary to enter the name of the Nominee person, in case of an accident, transfer of nominee to the deposits in the demat account.

Q. What are the basics of the Demat account?

A. You already know what a demat account really is. Let’s now know more about the basics of the demat account before we start talking about the informative report of demat accounts. Check out the basics related to the demat account below